Infrastructure that puts mortgages in millions of hands

No red tape. No delays. Just seamless B2B delivery at scale.

spent on Spring by 3,000+ business owners

Spring

Spring

Spring

Spring

Spring

Spring

Spring

Spring

Spring

Spring

Spring

Spring

Who we're built for

Why use Spring

Nigeria has a housing deficit of 20+ million homes, yet mortgage penetration is less than 1%.

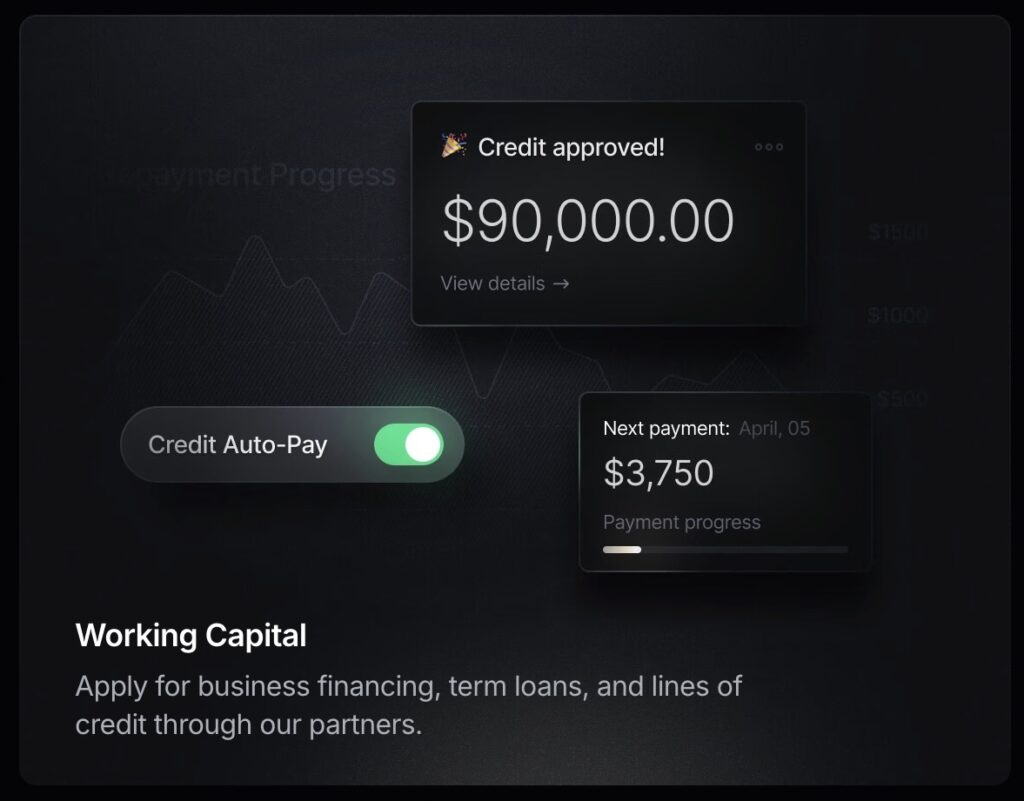

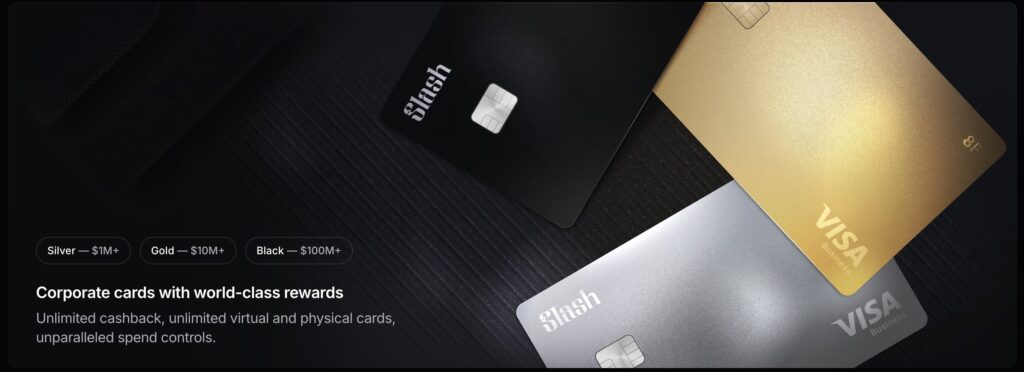

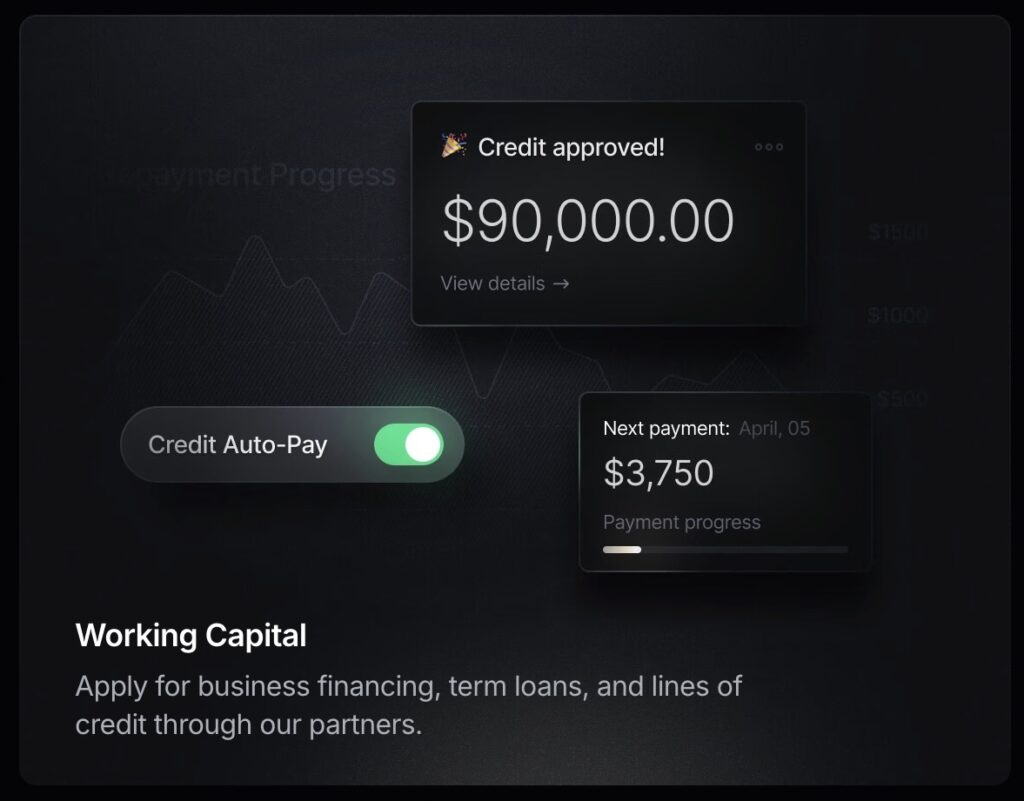

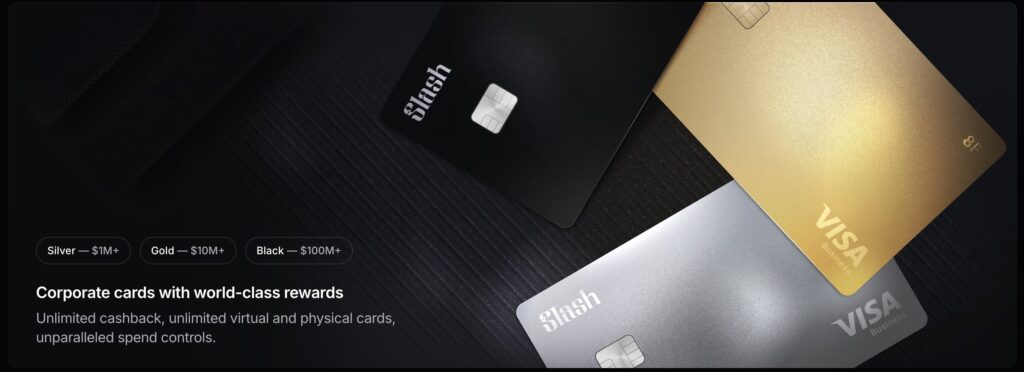

High-yield accounts, high cashback cards for Pro customers, and flexible working capital to fuel your business.

Get started in

three Steps

We provide The Backbone That Enables Buisnesses ,Fintechs, And Real Estate Firms

Plug In

Businesses integrate with Spring via API, widgets, or subdomains.

Offer Mortgages

Customers apply for mortgages through trusted brands they already engage with.

Bank Compliance

Mortgages are processed by AG Mortgage Bank — licensed, compliant, and reliable.

Real words, real impact

$5bn+

in yearly card spend

4m+

virtual cards issued

3k+

happy customers

$100m+

earned in cash back

We are the Stripe

for Mortgage

The Trusted Infrastructure Powering Africa's Mortgage Revolution.

For Banks & Fintechs

Add mortgage services to your app with one click.

For Lenders

Scale your lending faster and smarter with Spring’s infrastructure.

For Real Estate Firms

Sell more homes by bundling mortgages under your brand.

For Cooperatives & Churches

Empower members with affordable housing

For Employers

Offer staff mortgage benefits as part of compensation.

Products We Offer

Mortgage Infrastructure-as-a-Service (MIaaS)

White-label Solutions

Launch fully branded mortgage platforms effortlessly, allowing your business to provide seamless housing finance experiences supported by secure, scalable infrastructure instantly.

In-app/website Widgets

Integrate dynamic mortgage aggregator, eligibility tools, and application flows directly into your digital platforms, delivering fast housing finance access to customers

Mortgage Marketplace

A centralized digital marketplace where businesses, communities, and customers can explore, compare, and access multiple mortgage offerings in one seamless interface.

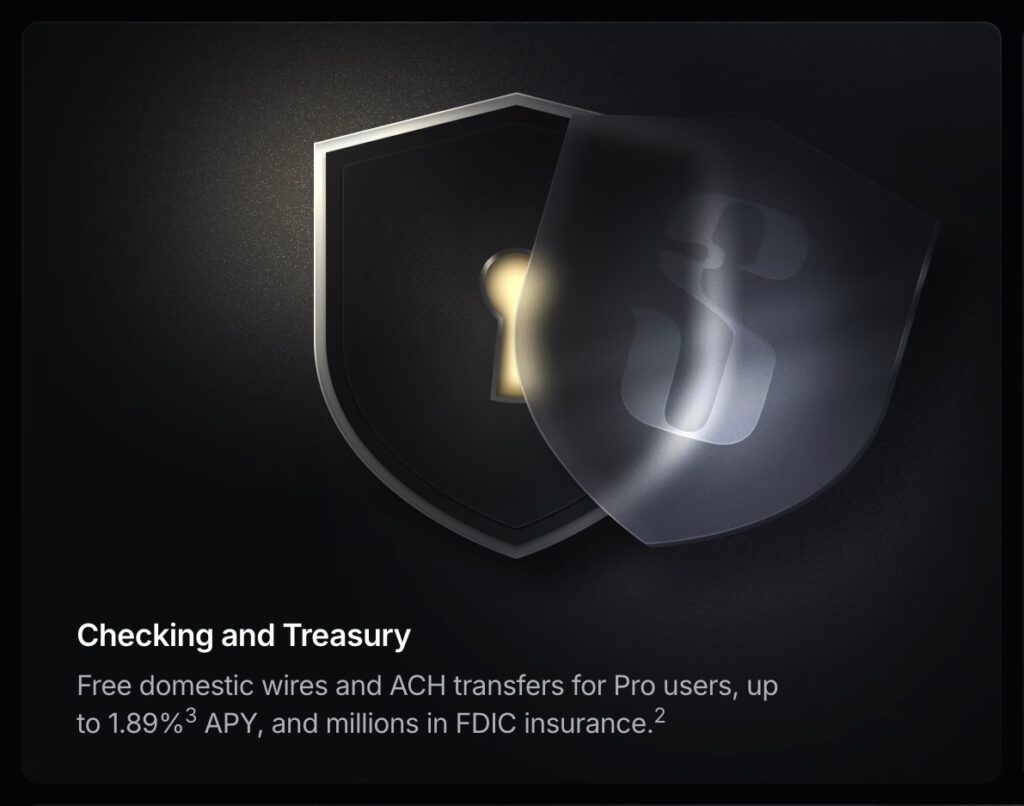

Multi-Layer Authentication

Sensitive actions such as onboarding, document uploads, and loan approvals are safeguarded by multi-factor authentication, device verification, and identity checks built directly into the platform.

Ready-to-Use APIs

Powerful, pre-built APIs that allow businesses to embed complete mortgage functionality into their platforms with minimal engineering effort.

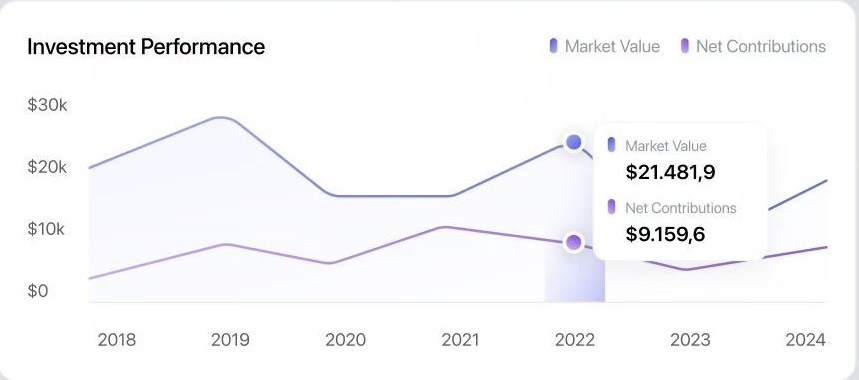

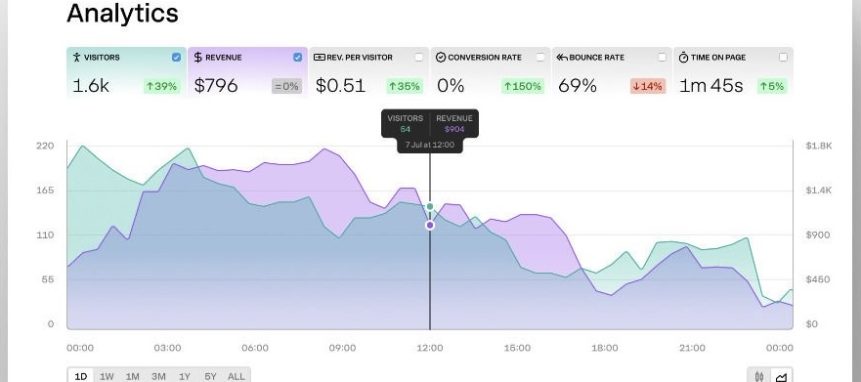

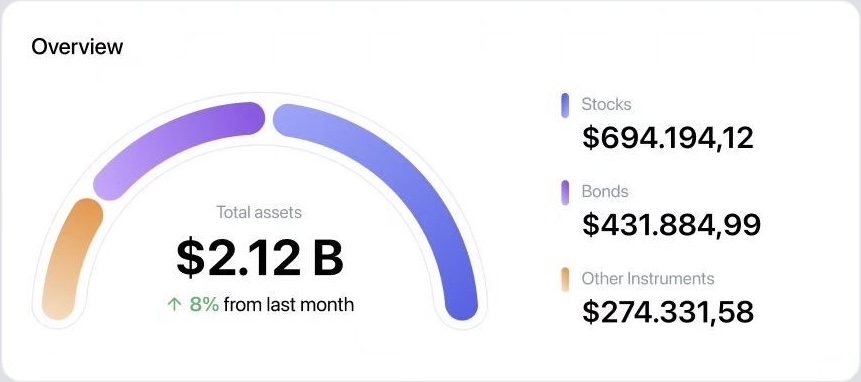

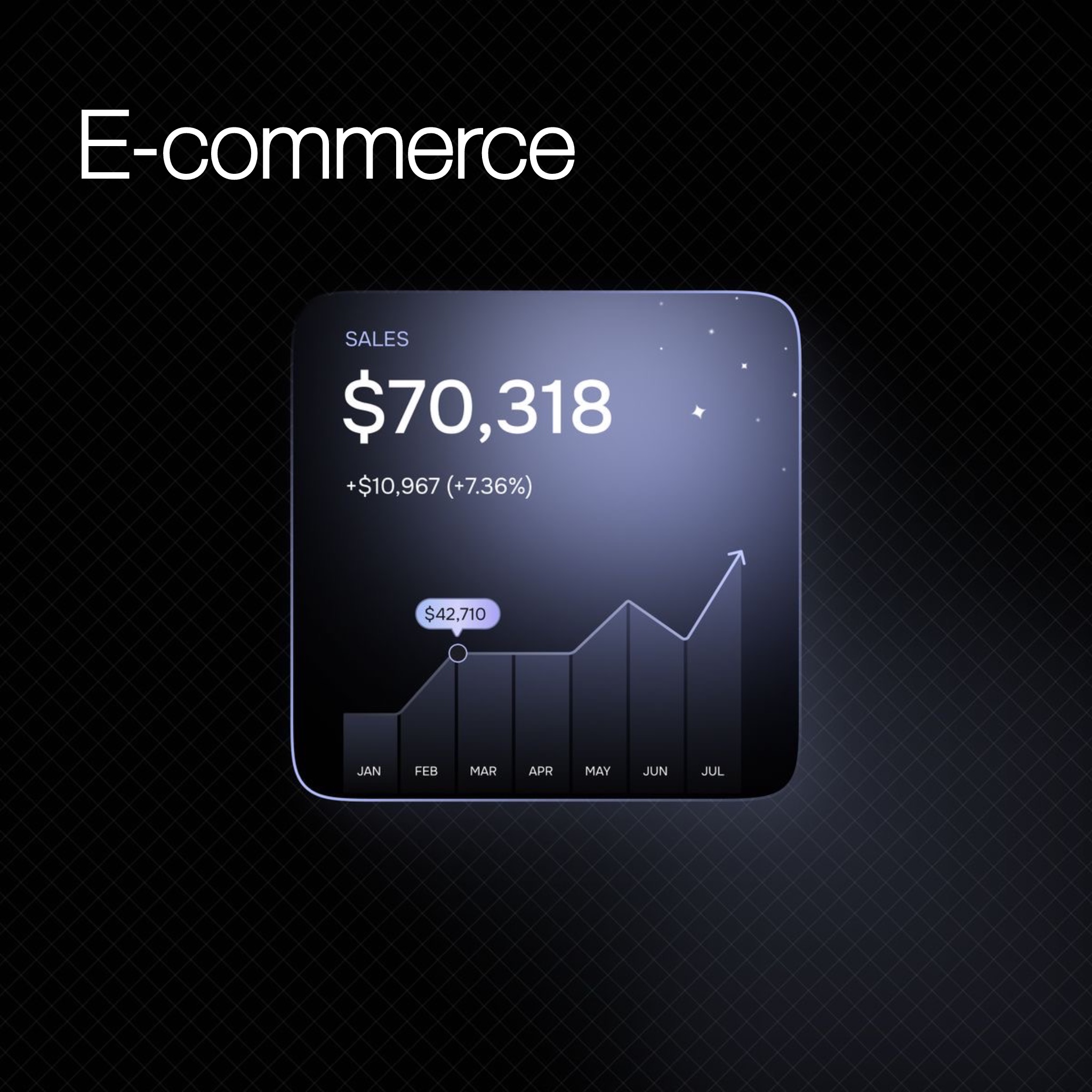

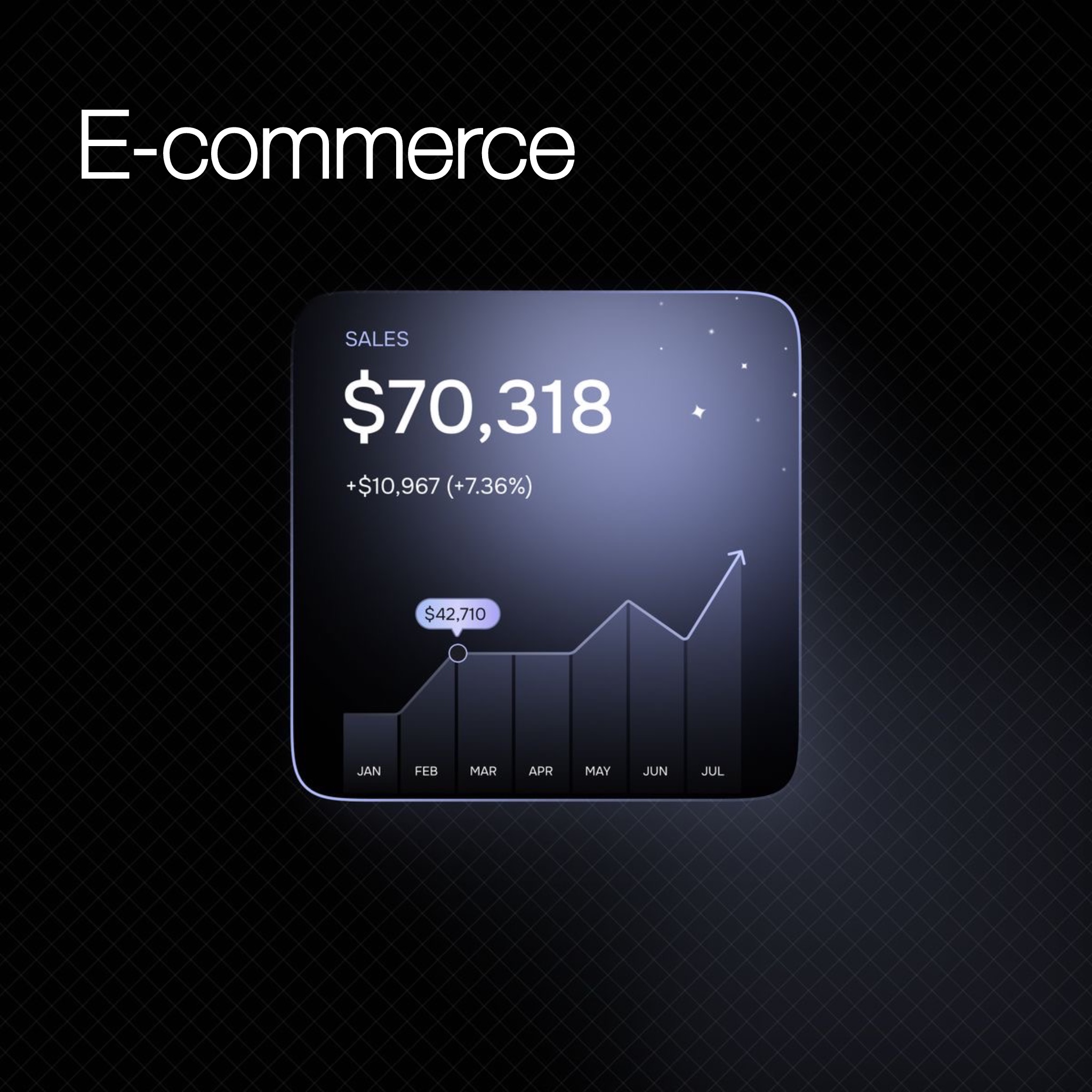

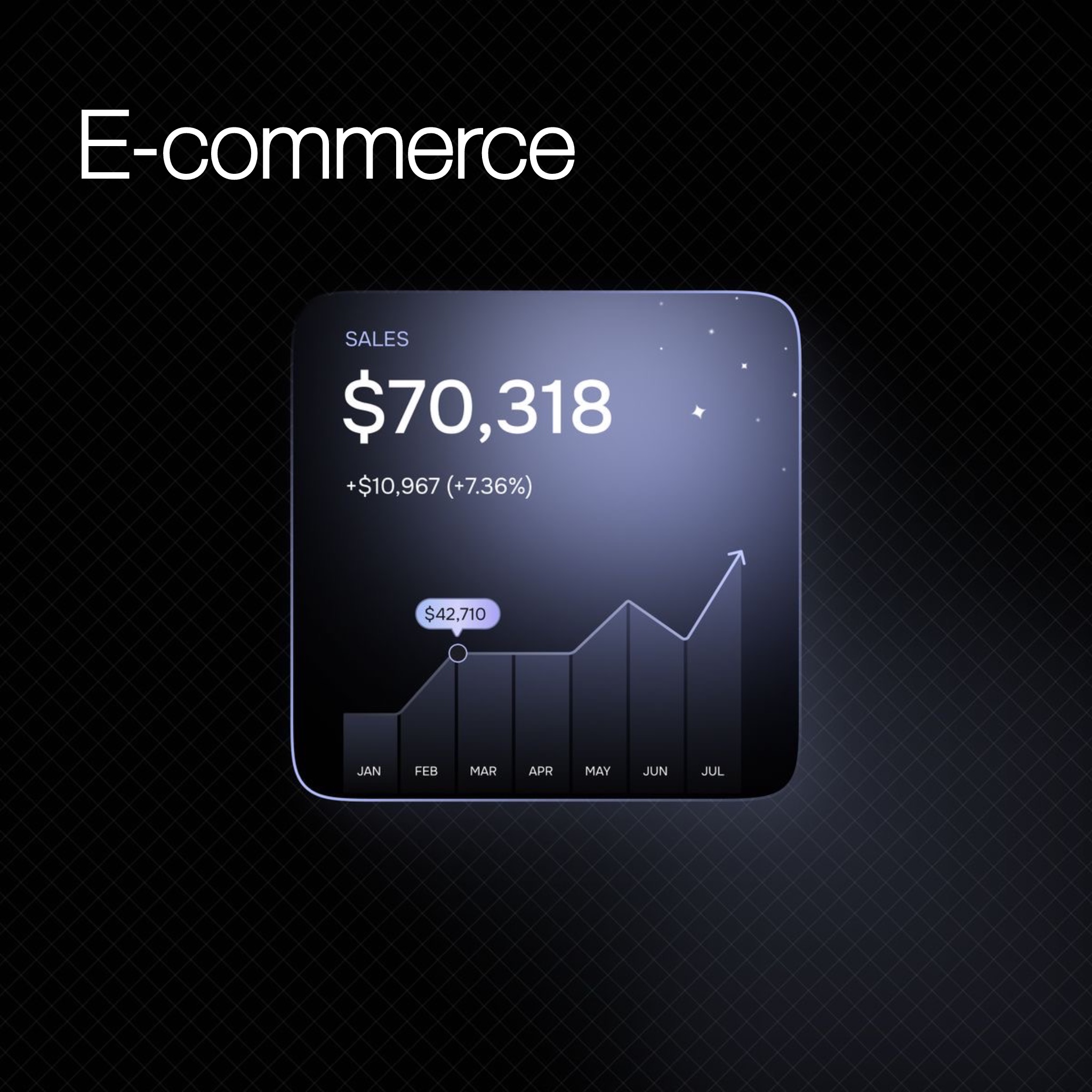

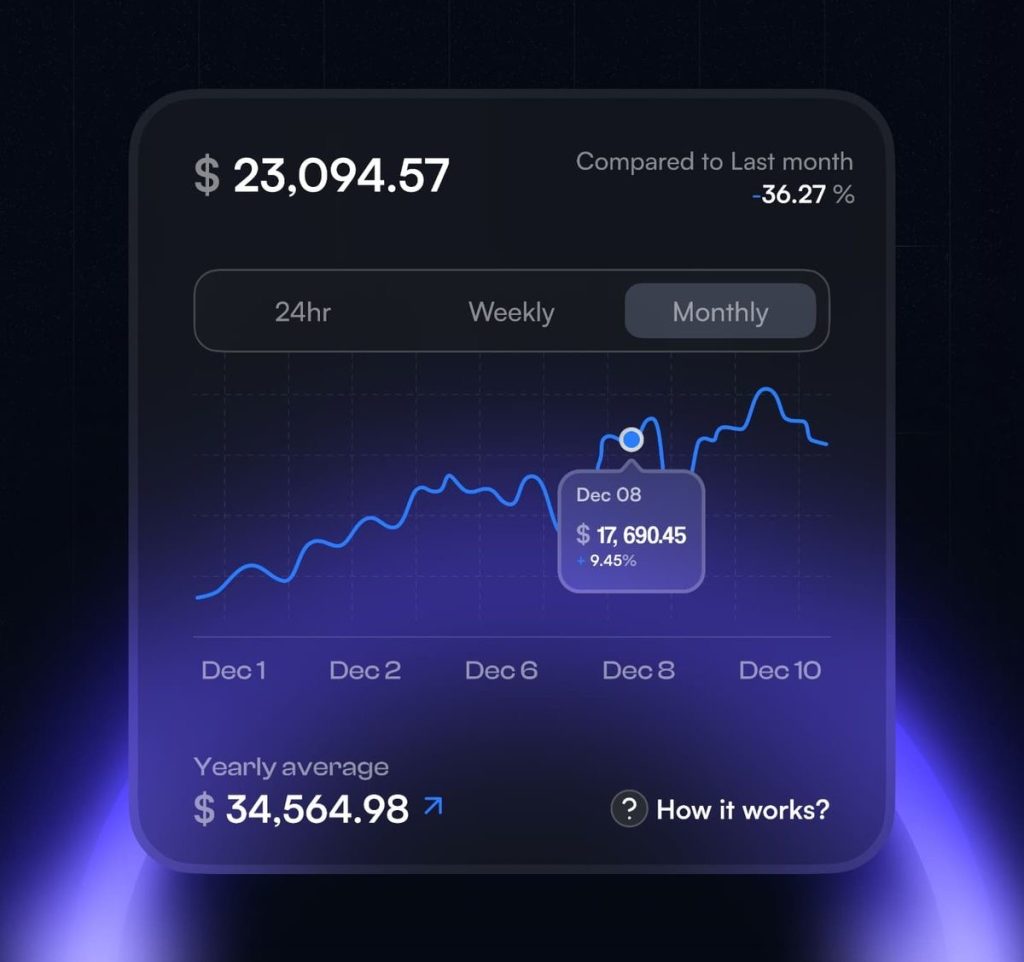

Insights that Shape the

Future of Mortgages.

For Banks / Fintechs

$5,000–$10,000

Full-featured banking essentials with no strings attached

✓ Full mortgage onboarding infrastructure

✓ White-label mortgage flows

✓ Plug-and-play eligibility engine

✓ Automated KYC/credit checks

✓ Mortgage calculator + affordability widget

✓ End-to-end document management

✓ Secure API access to AG Mortgage Bank

✓ Compliance-ready workflows

✓Multi-factor authentication for all users

For Custom Mortgage Services

$5,000–$10,000

Full-custom mortgage services with no strings attached

✓ Instant buyer pre-qualification tools

✓ Automated affordability assessments

✓ Co-branded mortgage marketing assets

✓ Sales team access & role permissions

✓ Property-linked mortgage onboarding flows

✓ API access to AG Mortgage Bank underwriting

✓ Sales team access & role permissions

✓ Buyer credit checks & eligibility scoring

✓ Digitized offer letters & approval workflowsrs

Frequently

asked questions

Don’t see the answer you’re looking for?

Get in touch.

What is Spring?

Spring is a fintech infrastructure company transforming mortgage banking in Nigeria. We’re not a bank — we’re the backbone that enables businesses, fintechs, real estate firms, and community organizations to embed mortgage services seamlessly. In partnership with AG Mortgage Bank, we provide the infrastructure that makes mortgages accessible, fast, and part of everyday commerce.

Is there a limit to how much cashback I can earn?

Spring doesn’t operate a cashback program. As a B2B infrastructure provider, we focus on enabling businesses, banks, and organizations to offer mortgage services to their customers.

However, our partners may choose to offer incentives, rewards, or cashback programs as part of their mortgage packages. Any limits or terms would be determined by the specific partner you’re working with. Check with your mortgage provider for details on available benefits.

Are there any account fees with Spring?

Spring doesn’t charge you directly. We provide the infrastructure that powers mortgages through your trusted banks, merchants, and institutions.

Any fees you encounter will be part of your mortgage terms with the partner you’re working with — whether that’s your bank, real estate firm, church, or cooperative.

Why should I use Spring?

Spring makes mortgages seamless, scalable, and accessible. Whether you’re a business looking to offer mortgages under your brand, a bank wanting to scale distribution, or a customer seeking affordable home financing — Spring provides the trusted infrastructure that makes it all possible.

We handle the complex stuff (compliance, processing, technology) so our partners can focus on serving you better.

Is Spring safe?

Yes. We use bank-grade encryption and comply with Nigeria Data Protection Regulation (NDPR). All mortgages are processed through AG Mortgage Bank, a licensed and regulated institution.

Your data is secure, never sold, and you can request, export, or delete your information anytime.